The situation of various retail space projects in the fourth quarter has been in a positive direction throughout the third quarter, continuing until mid-December 2021. Although it has not returned to normal as before the virus surveillance situation were taken.

There are still quite a few tenants or shops to bear the costs during the declining income since 2020. Many tenants have gradually closed the shop or requested to return the leased space. This includes tenants selling fashion items that can be sold online and a small restaurant with few branches. While some brand-name tenants or being a tenant with a large number of branches continue to expand.

Closing of renovations of some areas within the retail project, including the refurbishment of areas within the retail centers is seen continuously. Especially in large shopping centers in the city center, because some of the customers are foreign tourists who disappeared due to the COVID-19 situation. Because the tenants who are shops facing the problem of lack of income. Although some retail project owners agree to reduce their rents by 30 – 60%, there are still some tenants who are requesting to return the leased space.

Supply

Bangkok and Surrounding Area Retail Market as of Q4 2021

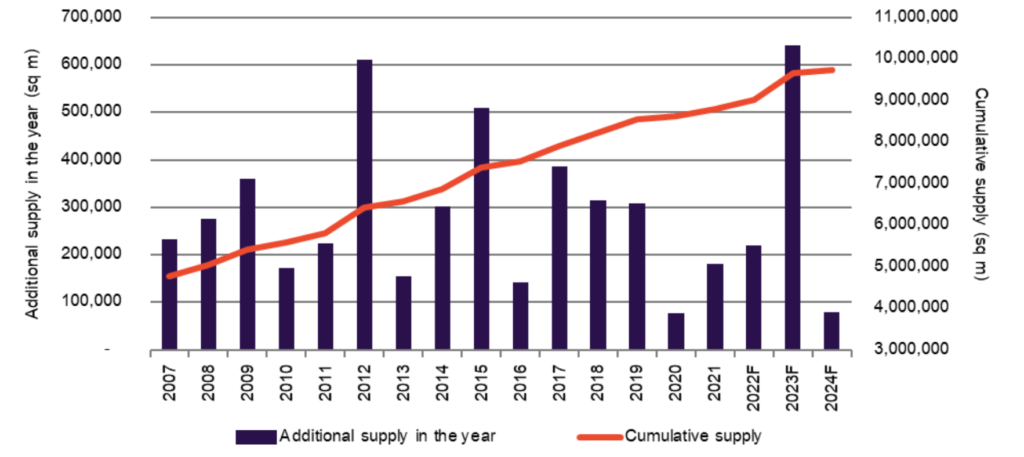

The retail market in Bangkok and surrounding areas in the fourth quarter of 2021 has 41,420 square meters of new retail space opened. Only 94,700 square meters of new retail space has been opened in 2021. Although very few compared to the past few years, but still about 21% more than the past year. But it does not mean that developers are confident in the economy and purchasing power of the Thai people. Because most of the projects are community malls in the Suburban Bangkok area with customer groups that are people in the surrounding area of the project. It does not focus on city center officers or foreign tourists.

Community malls in the Suburban Bangkok area may face problems with tenants being unable to continue their business in the long term. Because of the impact that has occurred since the previous year, continuing until 2021. The retail projects that were located under a lease may choose not to renew the lease upon expiration of the lease term. Especially the community mall that is not far from the shopping center or other larger retail space projects. Some new shopping malls opened in any province including the renovation of the new area, the layout of the rental area is completely new. Not separating the area between tenant areas and the department store part. Customers may not be able to notice which part of the shopping center they walk and increase the proportion of restaurants more clearly, there are different types of tenant zones more clear.

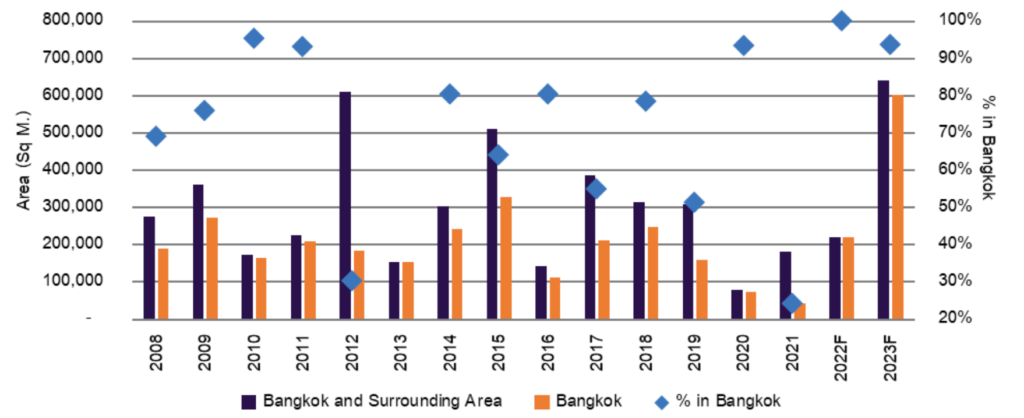

Comparison of New Retail Spaces Open Yearly

Most of the retail projects opened in Bangkok and surrounding areas are in Bangkok. There may be some years when large retail space projects are opened in areas outside of Bangkok that are contiguous or connected to Bangkok. Many new retail projects to be opened in areas outside Bangkok are mostly along Kanchanaphisek road or outer ring road and Ratchaphruek road, where the retail projects opened in the area along those roads in the past 10 years, including in the future, will have both large shopping mall, hypermarkets, specialty stores and community malls

Demand

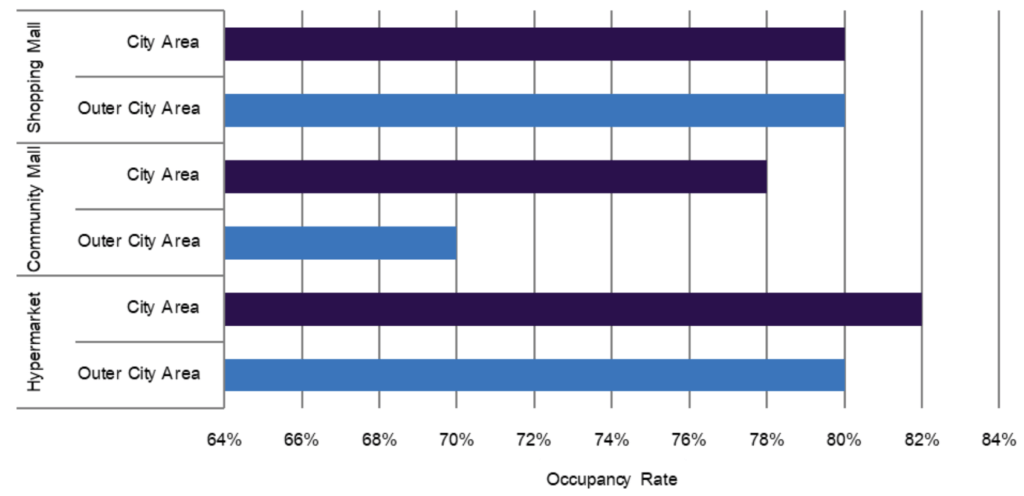

Average Occupancy Rate of All Retail Projects by Categories and Location

The occupancy rate in some retail projects, especially small projects or projects with not much rental space, such as community malls, hypermarkets have more vacancy space. Because many tenants have already canceled the lease space. This has continued to reduce the overall average occupancy rate in some areas. Although the overall market, the average occupancy rate of various category of retail projects are still at a relatively high rate. But it’s down about 5 – 10% from the previous year, depending on location and retail format.

Some stores or brands that are owned by large operators or have just arrived in Thailand continue to expand branches. While small tenants or shops can’t bear expenses in a situation where incomes continue to decline. As a result, the vacant space in the retail project has increased compared to the previous year. Although the end of the year is a festive season, due to the COVID-19 situation, as a result, the atmosphere is not as bustling as it should be. But there is some spending from government stimulus and people who want to relax from Covid-19.

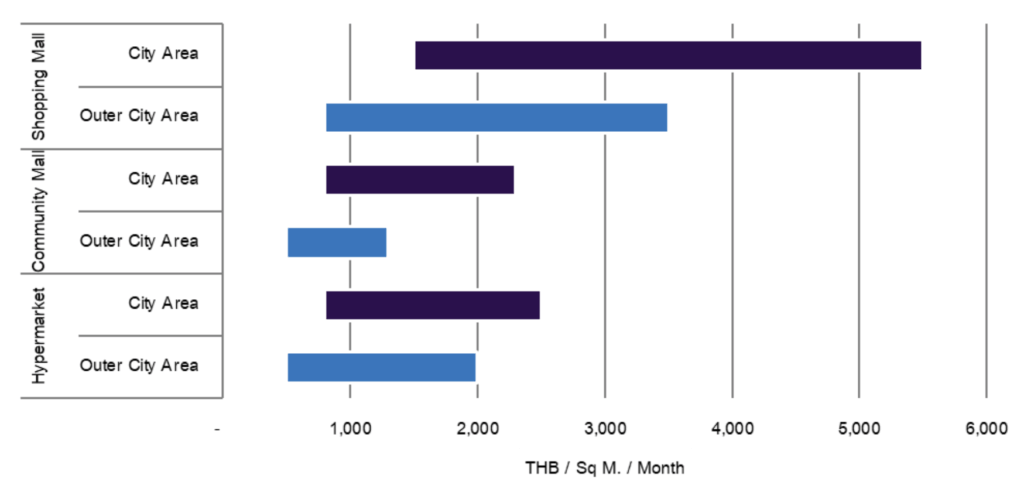

Rental Rates

Average Rental Rate of Retail projects by Categories

The average rental rate of each category of retail projects is varied and the location of the project also affects the rental. Community malls in the Suburban Bangkok Area or in the surrounding provinces cannot claim high rental rates compared to projects located in the City Area. Many project owners try to maintain rental rates similar to the past. There may be some reductions in rent, but only a temporary reduction or a period of rental reduction for a period of time.

The business of restaurants in the retail project gradually improved in the second half of 2021, although there are still restrictions under Social Distancing conditions, there is a clear increase in revenue compared to the second quarter, but still not comparable to the before Covid-19 period. Retail project owners and retail operators have shifted the rental rate based on Gross Profit (GP) sharing model, both during COVID-19 and over the long term.

Summary of overview and future trends

Retail projects still do not recover or return to normal in 2021 and must be monitored continuously in 2022.

The retail market continues to be affected until social distancing is not taken into account.

Retail projects in the heart of the city in areas where some of the customers are foreign tourists will not recover until they allow foreigners to travel freely to Thailand.

Many tenants have had to close both temporarily and permanently in the past 1 – 2 years.

Rental rates continue to decline compared to the pre-COVID-19 period.

The re-furbishment of some areas in retail project or some zones are still ongoing.

The number of community mall projects to be opened in the future is higher than other types of retail projects.

Tenants with online sales channels reduce their physical space in retail projects.

The area of restaurant or food services are getting the high proportion in retail projects.