During the past 2 years, office buildings have been affected by COVID-19. Not different from other types of real estate projects, because working from home affects the need for office space and the lack of tenants’ income also affects the rental of space.

Many office buildings are subject to rent pressure from the tenants themselves and market conditions in which demand declines. The construction of some new office buildings has been postponed from the original completion date because covid-19 has an effect on the construction workers and continuity in construction. In addition, working from home affects rent contract decisions and finding new rental spaces, because companies have more flexible work. The number of people who have to go to work at the office has decreased, because of reducing the number of employees or switching to the office, so demand for large office space has decreased. High rental rate office spaces may not be in demand these days. Office buildings that are further away, but still along the BTS or MRT lines may be more interesting in the future.

Supply

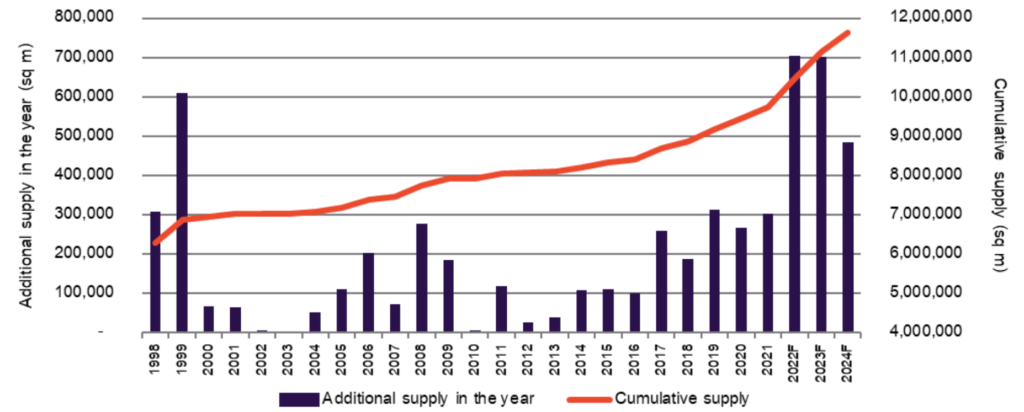

New Office Space in Each Year and Total Area in Bangkok Annually

Note: F = Forecast of office building area to be completed that year

At the end of 2021, the total office building area in Bangkok is approximately 9.7 million square meters. Since 2017, more than 150,000 square meters of new office space has been entered the market per year, which for many years has been more than 200,000 square meters. In 2022 – 2023, office spaces are expected to open up to 700,000 square meters per year. Although, there may be changes in the size of the area and the construction completion schedule. This is because the buildings that will be completed in 2022 – 2023 are all under construction. Many office buildings that are in the process of planning or considering investment plans have delayed making decisions or reviewing new investment development plans.

Covid-19 affects the office building market because working from home has become a common practice for today’s employees. This affects the decision to rent office space and expand office space including moving to a new office building. This is due to the need for smaller office spaces to meet today’s more flexible working styles than in the past. They can also work from anywhere nowadays. Therefore, many modern office buildings have adapted their internal rental spaces to accommodate a wider variety of office space rentals.

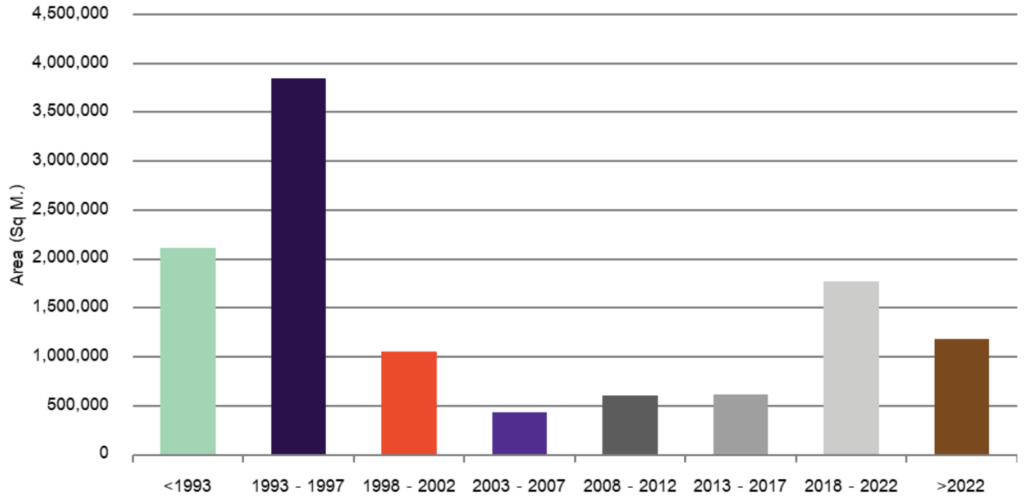

New Office Supply by Range of Year

The period 1993 – 1997 was the time when the Bangkok office space market grew the most in terms of supply and rental of office space. Because there are many buildings in the period before 1997 with rents more than 500 – 600 baht per square meter per month. But after the financial crisis in1997, many office buildings stopped construction and the area of new office buildings entering the market continues to decline, while office rents have been increasing continuously in line with the expansion of demand for office space. In the period after 1997, office buildings increased in a very small proportion compared to the period 1993 – 1997, but during the period from 2018 onwards, many office buildings entered the market.

A large number of office buildings have entered the market over the years. Although not as much as in the past, it started to cause concern to the owners of the old office building that previously had fully occupied. Since the new office building is in the same location as the old building, some tenants may move away from the old building. Because they need a larger rental space even if the rental rate is higher because the previously leased building cannot expand the leased space or need to rent more than 1 floor. But during this period there may be not much building or expansion, due to the Covid-19 situation.

Demand

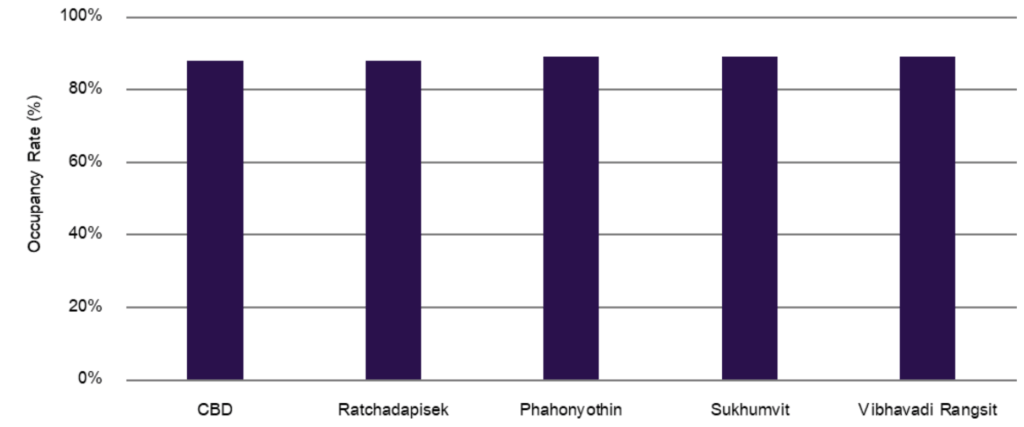

Average Occupancy Rate in the Important Zones of Bangkok

About the Covid-19 virus that began to affect business expansion or doing business abroad since the second half of 2019. The average occupancy rate of office space in Bangkok as of Q4 2021 was approximately 88%, slightly down from the beginning of the year. Because of the reduction of rental space or reclaiming office space of many companies affecting the overall office building market. In addition, the increase of new office buildings in many locations affects the average occupancy rate of the entire market. Because demand for office space is not much, with new office space entering the market, various factors affect the average occupancy rate.

New office buildings that have been opened in the past 1-2 years, some buildings have not yet filled the space. Unlike before COVID-19 most of the office buildings have more than 50-70% occupancy rate or some buildings are 100% occupied, since the buildings are not yet completed. This reflects the decline in demand for office space only in 2021 that many businesses have been affected continuously since the previous year.

Rental Rates

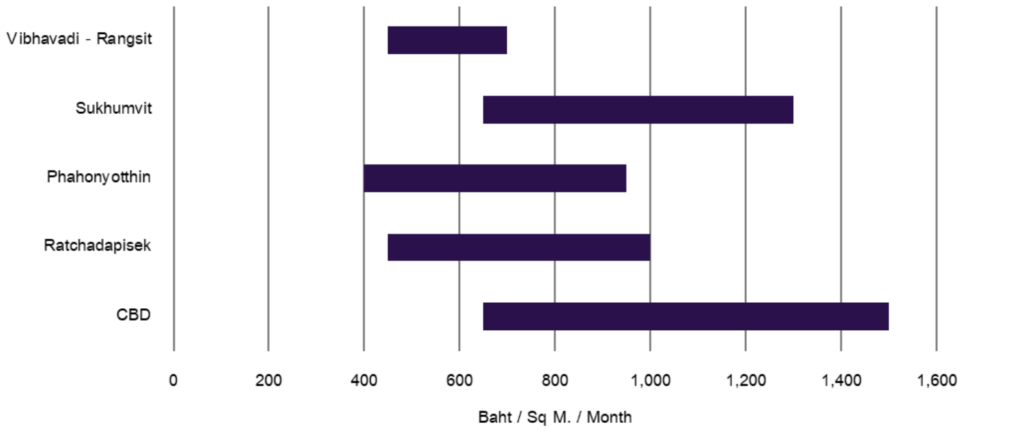

Average Rental Rates in The Important Zones of Bangkok

Office space rental rates as of the 4th quarter of 2021 decreased not much from the same period of the previous year. But some buildings are reduced by 5 – 10% depending on the vacancy rate of office space. Although negotiations for price reductions or rent negotiations have already been seen in some buildings, the reduction is not much overall. Or it may come in the form of keeping the rent at the same rate and then being able to extend the lease further. Some office building owners offer some rent reductions for only a short period.

The average rent for Grade A office space in the CBD is around 1,100 baht per square meter per month. While the same grade office buildings in areas outside the CBD are around 800 – 850 baht per square meter per month. Grade A office buildings in the CBD area can still claim a higher rent than similar grade buildings in other areas. However, it is still unable to attract or drive landlords in the CBD to develop office buildings because the rental income they receive is not suitable for land prices. May see new office buildings It has occurred in some other areas outside of the CBD in recent years. But the rent varies according to the building concept and the distance from the CBD area.

Rents for Grade A office buildings in CBD areas completed in the past 1-2 years are more than 1,200 baht per square meter per month, some buildings over 1,400 – 1,500 baht per square meter per month. Most of the office buildings that are under construction and scheduled to be completed in the next few years are mostly Grade A office buildings as well, so future office rents are likely to be much higher than the present when comparing buildings of the same grade in the same location. This must consider the economic condition and supply in the future, consisting of just having to look at the situation continuously, due to the impact of Covid-19. Because it results in a decrease in the rent of office space, especially office buildings with high rents, due to the decreased demand for rental space and there has been an increase in reclaiming of leased space over the past two years. Office owners may need to prioritize high occupancy rates over high rents. Therefore, new rents for office buildings under construction may be reviewed, including office buildings that used to say high rents in the current market

Summary of market overview and future trends

The office building market must be monitored for many more years.

The area of office buildings that are scheduled to enter the market in the next 3-4 years is more than 1 million square meters.

The demand for office space is highly variable and involves many factors.

The rent of office space in Bangkok in 2022 probably not different from the year 2021. There may be an increase, but not much.

Owners of old office buildings that have been completed for a long time need to renovate their buildings and systems in order to maintain market demand in the future.

Office owners may need to consider occupancy rates rather than rent increases.

The changing working style has the potential to affect the office building market in the future.